Reducing the interest rates of loan debt consolidation loans will help a lot. Yes. by means Debt consolidation is a certain process that will merge all debts into one particular debt. Eg. Credit card amount, home equity loan, debt consolidation loan, term loan, business loan., etc.

By doing this consolidation method borrowers will save more money by paying merged loans at lesser interest rates.

It will help you to pay monthly debt very easily by merging all debts into one debt.

Read More :

✅ How Keiser University Loan Forgiveness Program Helpful for Older Students?

✅ How Morgan Stanley Loan Administration Login Work?

✅ How Humana Dental and Health Insurance Helps for Policyholders?

✅ How Atlanta Insurance Lawyers Helpful for People?

What is a Debt Consolidation Loans? Have you heard of it before?

Instead of paying bulk interest rates to your debts, with the help of merging all debts into one debt helps you to pay a lesser amount compared to previous pay, This is called consolidation loan.

How to do?

Debt Consolidation is one of the easiest and simplest ways to consolidate all debts. If you apply for a loan from existing debt, and get approved you can use it from credit cards.

7 Best Debt Consolidation Loan (Lenders)- Must know

There are more lenders available for giving the best consolidation loan.

Let see one by one,

- Best Egg

- Happy Money

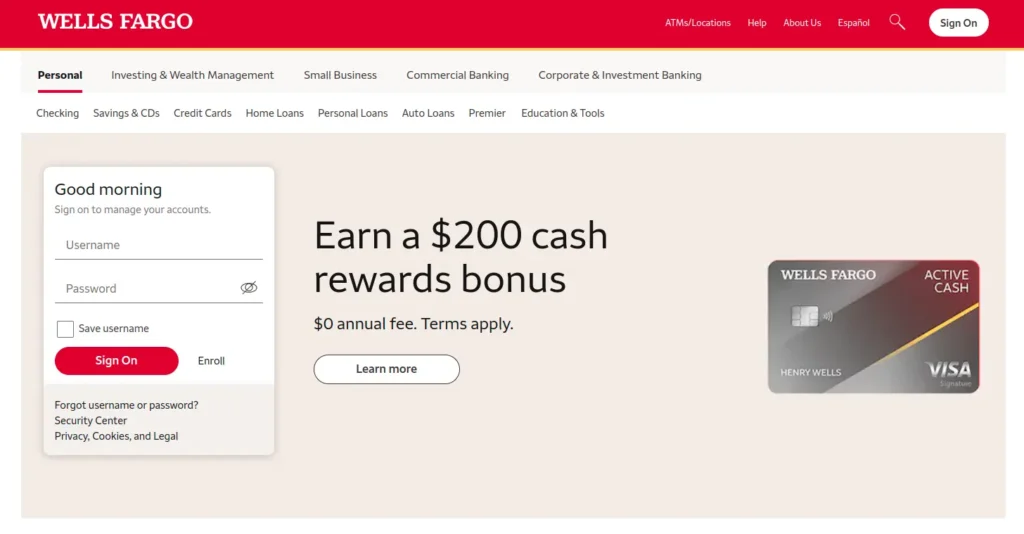

- Wells Fargo

- Light Stream

- Marcus

- Achieve

- Avant

Related Searches

- AI Live School Builder Review – Create & Launch Your Own LIVE School In A Minute

- World’s First AI “ Operator ” That Creates “AI Humans ” That Talk And Interact With Any Audience, In Any Language

- CloneBuddy AI Review: Build Your Websites in Just 60 Seconds

- AiSpokeStudio Review: How AI Avatars Are Transforming Content Creation in 2025

- Top 20 Advantages and Disadvantages of Business Ownership

Best Egg – Quick approve

Best Egg lenders will quickly approve your loans with consolidation.

In Bestegg you can get a loan amount from $2000 to $6000 according to your scores.

If you need loan from this bestegg you need to have more than 640 credit scores

Fee will be need to pay, It’s approximately 0.99% to 8.99%

You have to repay the amount within 3 to 5 years

Happy Money – Low credit score require

In Happy Money Lenders will give loan from $5k to $40K

To apply for this loan you need to have at least credit scores more than 640.

Fees will be less compared to BestEgg. In happy Money they will charge up to 5%

Terms to repay the debt amount from 2 years to 5 years.

Wells Fargo – One of the Long term Repayment

In wells fargo you will get approve the loan amount from $3K to $100K

If you have credit score 620, then you can eligible to apply

Origination fee is not there, it’s completely free of cost

You have to repay the loan amount from 1 year to 7 years

Lightstream – Loan has Low Interest rates

By applying lightstream you will get from $5K to $100K loan amount.

To apply this loan credit score will be not a big factor

There is no origination fee in lightstream

You can repay the loan amount from 2 years to 12 years.

Marcus – No need to pay Origination fee for Loan

Marcus company is also highly preferable by all.

From the Marcus company you can get a loan amount from $3.5K to $40K.

If you have credit score 720, you can apply it

No origination fee is required.

By getting a loan from this marcus, you have to pay repay amount from 3 years to 6 years.

Achieve – Quick Funding with Less rates

Achieve Loan will provide up to $5K to $50K.

Credit scores is need but it will be varies from loan amount

Origination fee will be there. You need to pay from 1.99% to 6.99%

If you get the approval from achieve loan amount, then you have to repay it from 2 years to 5 years

Avant – Best for Low Amount

In avant lenders you can get loan amount from $2K to $35K

If you have 600 credit score you can eligible for getting loan

You need to pay origination fee up to 4.75%

If you get an approval loan from avant, you need to repay it within 1 year to 5 year.

Is Debt Consolidation Loans Good idea when?

If you think these below needs are applicable for you, then you go with Debt consolidation.

- If you need to pay your all debt faster, then you can go with a consolidation loan.

- If you struggle to pay all credit card debt, then you can choose a consolidation loan to repay the credit cards bills as much earlier.

- If you are already in high APR, then you can choose a consolidation loan to reduce low APR.

- If you are interested to pay long term period for your loan amount

- If you are planning to not debt again with financial

Is Debt Consolidation Loans Bad idea when?

If you have less than the balance to pay debts quickly means it’s not fit for you.

How Will Debt Consolidation Loans Work?

If you need a consolidation loan, then you have to go with a personal loan option. You can try personal loans from banks or other online lenders.

If they approve your Personal loan then you can pay off your debts or you can pay your debts manually with the help of cash.

This will help you to stay focused on paying loans with low rates and single payment monthly.

Some other common factors to pay the debts,

- Personal loans

- Credit Card balance transfer

- Home Equity loans

- Credit Counseling

How will you get consolidate debt with Personal loan

To consolidate debts with personal loan you have to follow these steps,

Step 1 – Check your eligibility of credit scores

Step 2 – Check and calculate your debts needed to borrow with lenders

Step 3 – Recheck your APR twice

Step 4 – Compare your APR with your lenders to save a money

Step 5 – Finalize your lender and apply for getting personal loan

Benefits of getting Debt Consolidation Loan

- By getting Debts consolidation loan you will be get benefit by following reason,

- Debt consolidation helps you to relax for monthly payment

- By applying for a consolidation loan with the best lenders you have a chance to get a loan amount from $4K to $100K. Mostly loan payment will increase depending on your credit scores.

- In Fixed Loan interest rates are not change, but in Credit cards interest rate will changes

- Some lenders do not ask origination fee, but some lenders ask to apply for it.

How to choose Best Debt Consolidation Loan Lenders?

According to your budget you need to choose the best consolidation loan lenders. Some lenders approve your loan without any hard enquiry.

Actually if you have some good credit scores then you have a high possibility to get approved for higher Loan amount more than $100K.

Before applying consolidation loan you need to do some basic steps to get benefit from consolidation,

Step 1 – See if the Lenders Features is good or bad like their processing, payment, repayment

Step 2 – Find if the lenders giving Loan amount expected by you

Step 3 – Check APR of loan amount, which is mandatory

Step 4 – Check the history of Lenders

Conclusion

Before Applying for best debt consolidation you need to qualify for their requirements first. To qualify for that you need to make your credit score with positive rates.

FAQ – Frequently Asked Question

Is Debt Consolidation worth it?

Yes, Ofcourse Debt consolidation is always worth it, when people use it in the correct way.

If Banks that do debt consolidation Loans?

Yes. Banks do debt consolidation loans with people if they have required details in it positively.

If Lenders that do debt consolidation Loans?

Obviously, Yes Online lenders, and other lenders highly do debt consolidation loan processes. Here some lenders not even asking credit scores.

If I get a Debt Consolidation Loans with Bad Credit?

Yes, you will get debt consolidation loan with bad credit but the lenders that providing loan for it has lesser than good creditors

How to get Debt Consolidations Loan online?

With the help of online lenders, you have a high chances to get debt consolidation loan maximum loan amount up to $40,000

Where can I get a Debt Consolidation Loan?

You can easily get debt consolidation loan in

Online lenders,

Credit union,

Banks., and more

Will Debt Consolidation Loan Hurt my Credit Scores?

Yes, it will hurt credit scores because of lenders. Lenders will do a hard credit check before apply your consolidation loan.

How will Qualify for Best Consolidation Loan?

By having a good credit score, and having required details you can qualify for consolidation loan.

Editor’s Choice

- AI Live School Builder Review – Create & Launch Your Own LIVE School In A Minute

- World’s First AI “ Operator ” That Creates “AI Humans ” That Talk And Interact With Any Audience, In Any Language

- CloneBuddy AI Review: Build Your Websites in Just 60 Seconds

- AiSpokeStudio Review: How AI Avatars Are Transforming Content Creation in 2025

- Top 20 Advantages and Disadvantages of Business Ownership

- What are the Advantages and Disadvantages of the Internet?